# This cell is added by sphinx-gallery

# It can be customized to whatever you like

%matplotlib inline

3-qubit Ising model in PyTorch¶

The interacting spins with variable coupling strengths of an Ising model can be used to simulate various machine learning concepts like Hopfield networks and Boltzmann machines (Schuld & Petruccione (2018)). They also closely imitate the underlying mathematics of a subclass of computational problems called Quadratic Unconstrained Binary Optimization (QUBO) problems.

Ising models are commonly encountered in the subject area of adiabatic quantum computing. Quantum annealing algorithms (for example, as performed on a D-wave system) are often used to find low-energy configurations of Ising problems. The optimization landscape of the Ising model is non-convex, which can make finding global minima challenging. In this tutorial, we get a closer look at this phenomenon by applying gradient descent techniques to a toy Ising model.

PennyLane implementation¶

This basic tutorial optimizes a 3-qubit Ising model using the PennyLane default.qubit device with PyTorch. In the absence of external fields, the Hamiltonian for this system is given by:

where each spin can be in the +1 or -1 spin state and \(J_{ij}\) are the nearest-neighbour coupling strengths.

For simplicity, the first spin can be assumed to be in the “up” state (+1 eigenstate of Pauli-Z operator) and the coupling matrix can be set to \(J = [1,-1]\). The rotation angles for the other two spins are then optimized so that the energy of the system is minimized for the given couplings.

import torch

from torch.autograd import Variable

import pennylane as qml

from pennylane import numpy as np

A three-qubit quantum circuit is initialized to represent the three spins:

dev = qml.device("default.qubit", wires=3)

@qml.qnode(dev, interface="torch")

def circuit(p1, p2):

# We use the general Rot(phi,theta,omega,wires) single-qubit operation

qml.Rot(p1[0], p1[1], p1[2], wires=1)

qml.Rot(p2[0], p2[1], p2[2], wires=2)

return [qml.expval(qml.PauliZ(i)) for i in range(3)]

The cost function to be minimized is defined as the energy of the spin configuration:

def cost(var1, var2):

# the circuit function returns a numpy array of Pauli-Z expectation values

spins = circuit(var1, var2)

# the expectation value of Pauli-Z is +1 for spin up and -1 for spin down

energy = -(1 * spins[0] * spins[1]) - (-1 * spins[1] * spins[2])

return energy

Sanity check¶

Let’s test the functions above using the \([s_1, s_2, s_3] = [1, -1, -1]\) spin configuration and the given coupling matrix. The total energy for this Ising model should be:

test1 = torch.tensor([0, np.pi, 0])

test2 = torch.tensor([0, np.pi, 0])

cost_check = cost(test1, test2)

print("Energy for [1, -1, -1] spin configuration:", cost_check)

Energy for [1, -1, -1] spin configuration: tensor(2.0000, dtype=torch.float64)

Random initialization¶

torch.manual_seed(56)

p1 = Variable((np.pi * torch.rand(3, dtype=torch.float64)), requires_grad=True)

p2 = Variable((np.pi * torch.rand(3, dtype=torch.float64)), requires_grad=True)

var_init = [p1, p2]

cost_init = cost(p1, p2)

print("Randomly initialized angles:")

print(p1)

print(p2)

print("Corresponding cost before optimization:")

print(cost_init)

Randomly initialized angles:

tensor([1.9632, 2.6022, 2.3277], dtype=torch.float64, requires_grad=True)

tensor([0.6521, 2.8474, 2.4300], dtype=torch.float64, requires_grad=True)

Corresponding cost before optimization:

tensor(1.6792, dtype=torch.float64, grad_fn=<SubBackward0>)

Optimization¶

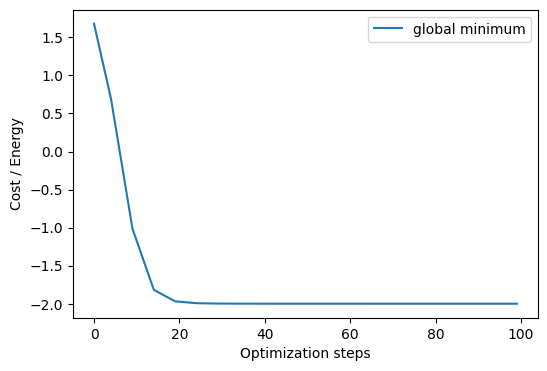

Now we use the PyTorch gradient descent optimizer to minimize the cost:

opt = torch.optim.SGD(var_init, lr=0.1)

def closure():

opt.zero_grad()

loss = cost(p1, p2)

loss.backward()

return loss

var_pt = [var_init]

cost_pt = [cost_init]

x = [0]

for i in range(100):

opt.step(closure)

if (i + 1) % 5 == 0:

x.append(i)

p1n, p2n = opt.param_groups[0]["params"]

costn = cost(p1n, p2n)

var_pt.append([p1n, p2n])

cost_pt.append(costn)

# for clarity, the angles are printed as numpy arrays

print("Energy after step {:5d}: {: .7f} | Angles: {}".format(

i+1, costn, [p1n.detach().numpy(), p2n.detach().numpy()]),"\n"

)

Energy after step 5: 0.6846474 | Angles: [array([1.96323939, 1.93604492, 2.32767565]), array([0.65212549, 2.73080219, 2.4299563 ])]

Energy after step 10: -1.0138530 | Angles: [array([1.96323939, 1.0136468 , 2.32767565]), array([0.65212549, 2.73225282, 2.4299563 ])]

Energy after step 15: -1.8171995 | Angles: [array([1.96323939, 0.38483073, 2.32767565]), array([0.65212549, 2.85992571, 2.4299563 ])]

Energy after step 20: -1.9686584 | Angles: [array([1.96323939, 0.13026452, 2.32767565]), array([0.65212549, 2.97097572, 2.4299563 ])]

Energy after step 25: -1.9930403 | Angles: [array([1.96323939, 0.04302756, 2.32767565]), array([0.65212549, 3.04042222, 2.4299563 ])]

Energy after step 30: -1.9980133 | Angles: [array([1.96323939, 0.01413292, 2.32767565]), array([0.65212549, 3.08179844, 2.4299563 ])]

Energy after step 35: -1.9993550 | Angles: [array([1.96323939, 0.00463472, 2.32767565]), array([0.65212549, 3.10627578, 2.4299563 ])]

Energy after step 40: -1.9997802 | Angles: [array([1.96323939e+00, 1.51911413e-03, 2.32767565e+00]), array([0.65212549, 3.12073668, 2.4299563 ])]

Energy after step 45: -1.9999239 | Angles: [array([1.96323939e+00, 4.97829828e-04, 2.32767565e+00]), array([0.65212549, 3.12927707, 2.4299563 ])]

Energy after step 50: -1.9999735 | Angles: [array([1.96323939e+00, 1.63134183e-04, 2.32767565e+00]), array([0.65212549, 3.13432035, 2.4299563 ])]

Energy after step 55: -1.9999908 | Angles: [array([1.96323939e+00, 5.34564150e-05, 2.32767565e+00]), array([0.65212549, 3.13729842, 2.4299563 ])]

Energy after step 60: -1.9999968 | Angles: [array([1.96323939e+00, 1.75166673e-05, 2.32767565e+00]), array([0.65212549, 3.13905695, 2.4299563 ])]

Energy after step 65: -1.9999989 | Angles: [array([1.96323939e+00, 5.73986944e-06, 2.32767565e+00]), array([0.65212549, 3.14009534, 2.4299563 ])]

Energy after step 70: -1.9999996 | Angles: [array([1.96323939e+00, 1.88084132e-06, 2.32767565e+00]), array([0.65212549, 3.14070851, 2.4299563 ])]

Energy after step 75: -1.9999999 | Angles: [array([1.96323939e+00, 6.16314188e-07, 2.32767565e+00]), array([0.65212549, 3.14107057, 2.4299563 ])]

Energy after step 80: -2.0000000 | Angles: [array([1.96323939e+00, 2.01953845e-07, 2.32767565e+00]), array([0.65212549, 3.14128437, 2.4299563 ])]

Energy after step 85: -2.0000000 | Angles: [array([1.96323939e+00, 6.61762372e-08, 2.32767565e+00]), array([0.65212549, 3.14141062, 2.4299563 ])]

Energy after step 90: -2.0000000 | Angles: [array([1.96323939e+00, 2.16846296e-08, 2.32767565e+00]), array([0.65212549, 3.14148516, 2.4299563 ])]

Energy after step 95: -2.0000000 | Angles: [array([1.96323939e+00, 7.10561943e-09, 2.32767565e+00]), array([0.65212549, 3.14152918, 2.4299563 ])]

Energy after step 100: -2.0000000 | Angles: [array([1.96323939e+00, 2.32836938e-09, 2.32767565e+00]), array([0.65212549, 3.14155517, 2.4299563 ])]

Note

When using the PyTorch optimizer, keep in mind that:

loss.backward()computes the gradient of the cost function with respect to all parameters withrequires_grad=True.opt.step()performs the parameter update based on this current gradient and the learning rate.opt.zero_grad()sets all the gradients back to zero. It’s important to call this beforeloss.backward()to avoid the accumulation of gradients from multiple passes.

Hence, its standard practice to define the closure() function that

clears up the old gradient, evaluates the new gradient and passes it

onto the optimizer in each step.

The minimum energy is -2 for the spin configuration \([s_1, s_2, s_3] = [1, 1, -1]\) which corresponds to \((\phi, \theta, \omega) = (0, 0, 0)\) for the second spin and \((\phi, \theta, \omega) = (0, \pi, 0)\) for the third spin. Note that gradient descent optimization might not find this global minimum due to the non-convex cost function, as is shown in the next section.

p1_final, p2_final = opt.param_groups[0]["params"]

print("Optimized angles:")

print(p1_final)

print(p2_final)

print("Final cost after optimization:")

print(cost(p1_final, p2_final))

Optimized angles:

tensor([1.9632e+00, 2.3284e-09, 2.3277e+00], dtype=torch.float64,

requires_grad=True)

tensor([0.6521, 3.1416, 2.4300], dtype=torch.float64, requires_grad=True)

Final cost after optimization:

tensor(-2.0000, dtype=torch.float64, grad_fn=<SubBackward0>)

import matplotlib

import matplotlib.pyplot as plt

fig = plt.figure(figsize=(6, 4))

# Enable processing the Torch trainable tensors

with torch.no_grad():

plt.plot(x, cost_pt, label = 'global minimum')

plt.xlabel("Optimization steps")

plt.ylabel("Cost / Energy")

plt.legend()

plt.show()

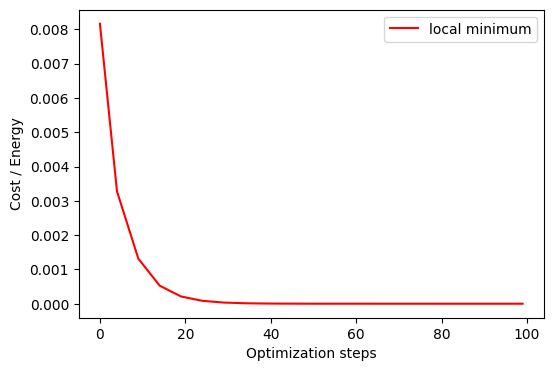

Local minimum¶

If the spins are initialized close to the local minimum of zero energy, the optimizer is likely to get stuck here and never find the global minimum at -2.

torch.manual_seed(9)

p3 = Variable((np.pi*torch.rand(3, dtype = torch.float64)), requires_grad = True)

p4 = Variable((np.pi*torch.rand(3, dtype = torch.float64)), requires_grad = True)

var_init_loc = [p3, p4]

cost_init_loc = cost(p3, p4)

print("Corresponding cost before optimization:")

print(cost_init_loc)

Corresponding cost before optimization:

tensor(0.0082, dtype=torch.float64, grad_fn=<SubBackward0>)

opt = torch.optim.SGD(var_init_loc, lr = 0.1)

def closure():

opt.zero_grad()

loss = cost(p3, p4)

loss.backward()

return loss

var_pt_loc = [var_init_loc]

cost_pt_loc = [cost_init_loc]

for j in range(100):

opt.step(closure)

if (j + 1) % 5 == 0:

p3n, p4n = opt.param_groups[0]['params']

costn = cost(p3n, p4n)

var_pt_loc.append([p3n, p4n])

cost_pt_loc.append(costn)

# for clarity, the angles are printed as numpy arrays

print('Energy after step {:5d}: {: .7f} | Angles: {}'.format(

j+1, costn, [p3n.detach().numpy(), p4n.detach().numpy()]),"\n"

)

Energy after step 5: 0.0032761 | Angles: [array([0.77369911, 2.63471297, 1.07981163]), array([0.26038622, 0.08659858, 1.91060734])]

Energy after step 10: 0.0013137 | Angles: [array([0.77369911, 2.63406019, 1.07981163]), array([0.26038622, 0.05483683, 1.91060734])]

Energy after step 15: 0.0005266 | Angles: [array([0.77369911, 2.63379816, 1.07981163]), array([0.26038622, 0.03471974, 1.91060734])]

Energy after step 20: 0.0002111 | Angles: [array([0.77369911, 2.63369307, 1.07981163]), array([0.26038622, 0.02198151, 1.91060734])]

Energy after step 25: 0.0000846 | Angles: [array([0.77369911, 2.63365094, 1.07981163]), array([0.26038622, 0.01391648, 1.91060734])]

Energy after step 30: 0.0000339 | Angles: [array([0.77369911, 2.63363405, 1.07981163]), array([0.26038622, 0.00881044, 1.91060734])]

Energy after step 35: 0.0000136 | Angles: [array([0.77369911, 2.63362729, 1.07981163]), array([0.26038622, 0.00557782, 1.91060734])]

Energy after step 40: 0.0000054 | Angles: [array([0.77369911, 2.63362457, 1.07981163]), array([0.26038622, 0.00353126, 1.91060734])]

Energy after step 45: 0.0000022 | Angles: [array([0.77369911, 2.63362348, 1.07981163]), array([0.26038622, 0.00223561, 1.91060734])]

Energy after step 50: 0.0000009 | Angles: [array([0.77369911, 2.63362305, 1.07981163]), array([2.60386222e-01, 1.41534339e-03, 1.91060734e+00])]

Energy after step 55: 0.0000004 | Angles: [array([0.77369911, 2.63362287, 1.07981163]), array([2.60386222e-01, 8.96040252e-04, 1.91060734e+00])]

Energy after step 60: 0.0000001 | Angles: [array([0.77369911, 2.6336228 , 1.07981163]), array([2.60386222e-01, 5.67274421e-04, 1.91060734e+00])]

Energy after step 65: 0.0000001 | Angles: [array([0.77369911, 2.63362278, 1.07981163]), array([2.60386222e-01, 3.59135947e-04, 1.91060734e+00])]

Energy after step 70: 0.0000000 | Angles: [array([0.77369911, 2.63362276, 1.07981163]), array([2.60386222e-01, 2.27365491e-04, 1.91060734e+00])]

Energy after step 75: 0.0000000 | Angles: [array([0.77369911, 2.63362276, 1.07981163]), array([2.60386222e-01, 1.43942891e-04, 1.91060734e+00])]

Energy after step 80: 0.0000000 | Angles: [array([0.77369911, 2.63362276, 1.07981163]), array([2.60386222e-01, 9.11288509e-05, 1.91060734e+00])]

Energy after step 85: 0.0000000 | Angles: [array([0.77369911, 2.63362276, 1.07981163]), array([2.60386222e-01, 5.76927932e-05, 1.91060734e+00])]

Energy after step 90: 0.0000000 | Angles: [array([0.77369911, 2.63362276, 1.07981163]), array([2.60386222e-01, 3.65247488e-05, 1.91060734e+00])]

Energy after step 95: 0.0000000 | Angles: [array([0.77369911, 2.63362276, 1.07981163]), array([2.60386222e-01, 2.31234648e-05, 1.91060734e+00])]

Energy after step 100: 0.0000000 | Angles: [array([0.77369911, 2.63362276, 1.07981163]), array([2.60386222e-01, 1.46392417e-05, 1.91060734e+00])]

fig = plt.figure(figsize=(6, 4))

# Enable processing the Torch trainable tensors

with torch.no_grad():

plt.plot(x, cost_pt_loc, 'r', label = 'local minimum')

plt.xlabel("Optimization steps")

plt.ylabel("Cost / Energy")

plt.legend()

plt.show()

Send it after class |¶

Try with different initialization parameters and see how the results change.

Two Types of Quantum Computers¶

It is not well-known what problems quantum computers can solve. We can classify quantum computers into “gate model” and “quantum annealing”. They have different use cases and architecture.

Gate Model¶

The quantum gate model computers are designed for universal purposes by applying gates to build complex algorithms. They can be considered the upward compatible machines of classical computers but exponentially fast if appropriate quantum algorithms like Shor and Grover are used. The applications include prime factorisation, which becomes a threat to the existing secure data transmission methods over the internet using RSA (Rivest–Shamir–Adleman) keys, quantum simulations which have the potential for finding new medicines, and machine learning. However, the gate model requires high-quality qubit processors; the number of qubits is limited to two digits (except for IBM’s exploratory 127-qubit Eagle system.)

Quantum Annealing¶

On the other hand, quantum annealers shine when they are used to search for the best from a vast number of possible combinations. Such challenges are called combinatorial optimisation problems. Many applications of quantum annealing have been reported recently. There are also researches to develop novel machine learning algorithms using quantum annealers. Amin et al. showed that there were possibilities to use quantum annealing hardware as a sampler for Boltzmann Machine by exploiting its quantum nature.

In physics, the minimum energy principle states that the internal energy decreases and approaches the minimum values. If we can formulate our problems in the form of an energy minimisation equation, the quantum annealer will be able to search for the best possible answer.

Quantum annealer is relatively noise-tolerant compared to the gate model. At the time of this writing, the most considerable number of qubits on a quantum processing unit (QPU) is at least five thousand provided by D-Wave’s Advantage solver. It is expected to increase more in the coming years. Five thousand qubits is a large number compared to what is achieved by the gate model. However, what we obtain from the annealer is as limited as a set of 5k-bit values per sampling. Furthermore, not all qubits are connected. Therefore, a hybrid system of classical computing and the quantum annealer is being developed to complement the capabilities of the two systems.

Annealing is a technique used to make quality iron products by heating the material to a certain degree of temperature and cooling it down slowly. The iron’s mechanical characteristics are altered through the heat treatment, which reduces the hardness and increases the elasticity.

Simulated annealing (SA) is a probabilistic technique whose name and idea are derived from annealing in material science. SA is a meta-heuristic in which algorithms approximate the global minimum or maximum of a given function. It uses a parameter called temperature that is initialised with a high value and decreases as the algorithm proceeds, like the physical annealing. High-temperature value promotes the algorithm to look for the various parts of the problem space, which helps to avoid being stuck in local minima or maxima. When the temperature goes down to zero, the state reaches the optimal point if successful. Going through the SA algorithm is outside the scope of this article, and the details on how it works can be found, for example, on the MathWorks website.

Quantum annealing (QA) is an algorithm to solve combinatorial optimisation problems mainly. Instead of using temperature to explore the problem space, QA uses the laws of quantum mechanics to measure the energy state. Starting from the qubits’ dual state, where all the possible combinations of the values are equally likely to happen, we can gradually reduce such quantum mechanical effects by the process called quantum fluctuation to reach the most optimal point where the lowest energy state is realised.

Kadowaki and Nishimori proved that QA converges to the optimal state with a much larger probability than SA in almost all cases on classical computers. The actual quantum annealing machines were developed by D-Wave and built on the ground of their theoretical framework.

Formulating Problem for QA¶

QA machines are specialised hardware to solve combinatorial optimisation problems. These problems can be found in many places in our life. For example, an Amazon delivery person needs to find the most optimal route to deliver all parcels given for the day. The objective is to find a route with the shortest distance to visit all the delivery addresses. We can treat the distance as the energy in the QA context and find the path that reaches the ground state. We can also think of a futuristic example where multiple autonomous cars are navigated to optimise the traffic in a specific city area with heavy traffic jams. The objective is to reduce the traffic by minimising the number of overlaps of cars taking the same route simultaneously while each car aims to optimise the travel time to a destination.

Quantum annealers require an objective function to be defined in the Ising model or Quadratic Unconstrained Binary Optimisation (QUBO). Ising model is a mathematical model in statistical mechanics. QUBO is mathematically equivalent to the Ising model and is much simpler to formulate a problem.

QUBO is a minimisation objective function expressed as follows:

where \(x_i\) and \(x_j\_ {i,j =0,1,…,N}\) takes 0 or 1. \(Q_{ij}\) is a coefficient matrix of size \(n \times n\), which we need to prepare for a QA machine. In case of a problem to search for a global maximum, we can flip the sign to minus to convert the problem into a minimisation problem.

In reality, a problem must be satisfied with one or more constraints. For example, a knapsack problem has a constraint of how many weights you can pack things in the bag. Such constraints are multiplied by weight parameters and are added to the objective function as penalty terms.

Implementation Using Quantum Annealer¶

In this section, we would like to code and solve a simple combinatorial optimisation problem in Python and the real Quantum Annealer by D-Wave.

Preparation¶

Before starting, we need to sign up for a cloud computing service. D-wave offers trial access to QA solvers with a sixty-second computational time allowance for one month. Please go to D-Wave Leap to find out more. After successful registration, the API token is available on the dashboard.

Problem Setting¶

We would like to challenge a simplified portfolio optimisation problem. Suppose there are twenty candidate stocks from FTSE100 to invest in. Our objective is to maximise an expected return rate at the minimum risk while keeping more or less ten stocks in our portfolio.

We will take the following six steps to solve the problem:

Import historical stock price data from the internet

Prepare data by cleansing and feature engineering

Formulate the cost functions and constraints to obtain a QUBO matrix

Sample optimisation results from a D-Wave solver

Sample optimisation results from a simulated quantum annealing solver

Evaluate the outcomes

Each of the above steps is demonstrated in a Colab notebook found in Python Coding in Colab Notebook section.

Dependencies¶

Some notes on the Python requirements:

yfinance is used to retrieve stock price data from Yahoo! Finance.

Prophet is a python package used to make time-series forecasting. It is possible to do multivariate time series forecasting and add holiday effects easily.

D-Wave Ocean SDK needs to be installed. The SDK includes packages that are necessary to communicate with D-Wave resources.

PyQUBO is a library that can construct QUBO from cost and constraints functions.

OpenJIJ is an open-source meta-heuristics library for the Ising model and QUBO. It simulates the quantum annealers and can be used to experiment without the D-Wave computers. It accepts QUBOs stored in a Python dictionary type.

Cost and Constraint Function¶

Our objective in this example is to minimise the sum of two cost functions and one constraint term, namely:

the maximisation of return rates

the minimisation of risks by lowering portfolio variance

the minimisation of the penalty term

The maximisation of the return rates can be formulated as a minimisation cost function:

where \(R_i\) is the return rate of the \(i\)th stock \(x_i\). Because \(x_i\) only takes a binary value \(0\) or \(1\), \(x_i\) is equivalent with the quadratic term \(x_i \times x_i\). Therefore, \(H_{cost1}\) function can be equivalent to the following QUBO:

The minimisation of portfolio variance is represented as :

where W denotes a covariance matrix.

The minimisation of the penalty can be formed in mean squared error (MSE) as a constraint term:

where K is the number of stocks to be selected for the portfolio.

\(H_{const}\) can also be transformed to the equivalent QUBOs by expanding the formula:

(Constraint term expanded for QUBO formulation)

\(-2K\sum_{i=1}^Nx_i\) part can also be equivalent to the quadratic form, as seen in the above \(H_{cost1}\) function. \(K^2\) is a constant value called offset which is not included in the QUBO matrix.

We will use the PyQUBO library in Python code to generate the QUBO matrix from functions for simplicity.

Thus, we can solve the problem by finding such x that minimises the function H(x) = (H_cost1 + H_cost2 + lambda*H_const), where lambda is a weight parameter for the constraint

1. Import historical stock price data from the internet¶

First of all, Install Yahoo finance library to retrieve stock data. We will import randomly selected 20 stocks from FTSE100 and extract the historical closing prices for the past 2 years from July 2020.

!pip install yfinance

/bin/bash: /home/obm/Prog/miniconda3/envs/qml/lib/libtinfo.so.6: no version information available (required by /bin/bash)

Requirement already satisfied: yfinance in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (0.2.3)

Requirement already satisfied: numpy>=1.16.5 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from yfinance) (1.23.4)

Requirement already satisfied: lxml>=4.9.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from yfinance) (4.9.2)

Requirement already satisfied: frozendict>=2.3.4 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from yfinance) (2.3.4)

Requirement already satisfied: beautifulsoup4>=4.11.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from yfinance) (4.11.1)

Requirement already satisfied: pandas>=1.3.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from yfinance) (1.5.1)

Requirement already satisfied: pytz>=2022.5 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from yfinance) (2022.7)

Requirement already satisfied: appdirs>=1.4.4 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from yfinance) (1.4.4)

Requirement already satisfied: multitasking>=0.0.7 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from yfinance) (0.0.11)

Requirement already satisfied: html5lib>=1.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from yfinance) (1.1)

Requirement already satisfied: cryptography>=3.3.2 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from yfinance) (37.0.1)

Requirement already satisfied: requests>=2.26 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from yfinance) (2.28.1)

Requirement already satisfied: soupsieve>1.2 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from beautifulsoup4>=4.11.1->yfinance) (2.3.1)

Requirement already satisfied: cffi>=1.12 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from cryptography>=3.3.2->yfinance) (1.15.1)

Requirement already satisfied: webencodings in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from html5lib>=1.1->yfinance) (0.5.1)

Requirement already satisfied: six>=1.9 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from html5lib>=1.1->yfinance) (1.16.0)

Requirement already satisfied: python-dateutil>=2.8.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from pandas>=1.3.0->yfinance) (2.8.2)

Requirement already satisfied: idna<4,>=2.5 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from requests>=2.26->yfinance) (3.4)

Requirement already satisfied: certifi>=2017.4.17 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from requests>=2.26->yfinance) (2022.9.24)

Requirement already satisfied: urllib3<1.27,>=1.21.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from requests>=2.26->yfinance) (1.26.12)

Requirement already satisfied: charset-normalizer<3,>=2 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from requests>=2.26->yfinance) (2.1.1)

Requirement already satisfied: pycparser in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from cffi>=1.12->cryptography>=3.3.2->yfinance) (2.21)

[notice] A new release of pip available: 22.3 -> 22.3.1

[notice] To update, run: pip install --upgrade pip

import yfinance as yf

import numpy as np

import pandas as pd

# list of FTSE100 stocks available at

# https://www.londonstockexchange.com/indices/ftse-100/constituents/table

# below are randomly selected stocks

stocks_dict = {

'FLTR.L':'FLUTTER ENTERTAINMENT PLC',

'SVT.L':'SEVERN TRENT PLC',

'LSEG.L':'LONDON STOCK EXCHANGE GROUP PLC',

'BNZL.L':'BUNZL PLC',

'CPG.L':'COMPASS GROUP PLC',

'NXT.L':'NEXT PLC',

'ULVR.L':'UNILEVER PLC',

'SHEL.L':'SHELL PLC',

'CCH.L':'COCA-COLA HBC A',

'BRBY.L':'BURBERRY GROUP PLC',

'SSE.L':'SSE PLC',

'REL.L':'RELX PLC',

'EXPN.L':'EXPERIAN PLC',

'DCC.L':'DCC PLC ORD',

'AZN.L':'ASTRAZENECA PLC',

'GSK.L':'GSK PLC ORD',

'ADM.L':'ADMIRAL GROUP PLC',

'SDR.L':'SCHRODERS PLC',

'BATS.L':'BRITISH AMERICAN TOBACCO PLC',

'IHG.L':'INTERCONTINENTAL HOTELS GROUP PLC',

}

stocks = list(stocks_dict.keys()) # list of candidate stocks

data = yf.download(stocks,'2020-07-01','2022-04-30')['Close'] # main data

data_test = yf.download(stocks,'2022-05-01','2022-07-24')['Close'] # testing data

[ 0% ]

[***** 10% ] 2 of 20 completed

[******* 15% ] 3 of 20 completed

[******* 15% ] 3 of 20 completed

[******* 15% ] 3 of 20 completed

[******* 15% ] 3 of 20 completed

[***************** 35% ] 7 of 20 completed

[***************** 35% ] 7 of 20 completed

[***************** 35% ] 7 of 20 completed

[**********************50% ] 10 of 20 completed

[**********************50% ] 10 of 20 completed

[**********************60%**** ] 12 of 20 completed

[**********************60%**** ] 12 of 20 completed

[**********************60%**** ] 12 of 20 completed

[**********************75%*********** ] 15 of 20 completed

[**********************75%*********** ] 15 of 20 completed

[**********************85%**************** ] 17 of 20 completed

[**********************90%****************** ] 18 of 20 completed

[**********************95%********************* ] 19 of 20 completed

[*********************100%***********************] 20 of 20 completed

[ 0% ]

[***** 10% ] 2 of 20 completed

[***** 10% ] 2 of 20 completed

[********** 20% ] 4 of 20 completed

[********** 20% ] 4 of 20 completed

[********** 20% ] 4 of 20 completed

[********** 20% ] 4 of 20 completed

[******************* 40% ] 8 of 20 completed

[**********************45% ] 9 of 20 completed

[**********************45% ] 9 of 20 completed

[**********************45% ] 9 of 20 completed

[**********************60%**** ] 12 of 20 completed

[**********************60%**** ] 12 of 20 completed

[**********************60%**** ] 12 of 20 completed

[**********************60%**** ] 12 of 20 completed

[**********************60%**** ] 12 of 20 completed

[**********************85%**************** ] 17 of 20 completed

[**********************90%****************** ] 18 of 20 completed

[**********************95%********************* ] 19 of 20 completed

[*********************100%***********************] 20 of 20 completed

data.describe()

| ADM.L | AZN.L | BATS.L | BNZL.L | BRBY.L | CCH.L | CPG.L | DCC.L | EXPN.L | FLTR.L | GSK.L | IHG.L | LSEG.L | NXT.L | REL.L | SDR.L | SHEL.L | SSE.L | SVT.L | ULVR.L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 464.000000 | 464.000000 | 463.000000 | 464.000000 | 464.000000 | 464.000000 | 463.000000 | 463.000000 | 463.000000 | 464.000000 | 464.000000 | 463.000000 | 464.000000 | 464.000000 | 464.000000 | 464.000000 | 463.000000 | 464.000000 | 464.000000 | 464.000000 |

| mean | 2949.351293 | 8366.258621 | 2787.561555 | 2537.961207 | 1804.203375 | 2294.758621 | 1466.997840 | 6042.596112 | 2933.794816 | 12754.031149 | 1475.618385 | 4722.868251 | 7975.392241 | 7204.778017 | 1997.713362 | 568.022027 | 1489.860042 | 1503.168103 | 2601.586207 | 4142.657884 |

| std | 298.590229 | 753.326915 | 223.859266 | 228.969271 | 228.739954 | 314.297710 | 176.851449 | 420.743959 | 288.931273 | 2003.651264 | 128.447452 | 399.235132 | 794.814741 | 952.486937 | 248.250476 | 52.854523 | 299.833511 | 144.853407 | 241.375319 | 357.982299 |

| min | 2240.000000 | 6794.000000 | 2448.000000 | 2131.000000 | 1252.500000 | 1460.500000 | 1050.500000 | 5006.000000 | 2273.000000 | 7922.000000 | 1199.561523 | 3516.000000 | 6370.000000 | 4673.000000 | 1527.500000 | 442.510010 | 900.000000 | 1171.000000 | 2168.000000 | 3328.000000 |

| 25% | 2756.750000 | 7931.500000 | 2643.750000 | 2363.000000 | 1630.000000 | 2073.000000 | 1393.250000 | 5785.000000 | 2738.000000 | 11400.000000 | 1385.821991 | 4549.000000 | 7371.500000 | 6282.000000 | 1788.625000 | 519.009995 | 1333.299988 | 1384.875000 | 2413.250000 | 3911.125000 |

| 50% | 2962.000000 | 8413.000000 | 2734.000000 | 2479.500000 | 1820.250000 | 2372.500000 | 1497.500000 | 6030.000000 | 2893.000000 | 12890.000000 | 1446.565674 | 4812.000000 | 7939.000000 | 7660.000000 | 1918.250000 | 587.179993 | 1440.400024 | 1524.250000 | 2511.000000 | 4124.500000 |

| 75% | 3116.250000 | 8678.250000 | 2825.750000 | 2712.750000 | 1965.250000 | 2532.250000 | 1586.250000 | 6268.000000 | 3109.000000 | 14282.500000 | 1579.234680 | 5026.000000 | 8596.000000 | 7980.500000 | 2227.250000 | 606.942520 | 1660.300049 | 1612.000000 | 2823.000000 | 4358.500000 |

| max | 3688.000000 | 10930.000000 | 3439.000000 | 3163.000000 | 2264.000000 | 2784.000000 | 1820.500000 | 7204.000000 | 3667.000000 | 16915.000000 | 1823.720459 | 5338.000000 | 9910.000000 | 8426.000000 | 2449.000000 | 658.070007 | 2228.000000 | 1868.500000 | 3211.000000 | 4892.000000 |

data_test.describe()

| ADM.L | AZN.L | BATS.L | BNZL.L | BRBY.L | CCH.L | CPG.L | DCC.L | EXPN.L | FLTR.L | GSK.L | IHG.L | LSEG.L | NXT.L | REL.L | SDR.L | SHEL.L | SSE.L | SVT.L | ULVR.L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 | 57.000000 |

| mean | 2185.973684 | 10508.228070 | 3466.447368 | 2814.035088 | 1629.964912 | 1777.026316 | 1710.345614 | 5494.614035 | 2555.052632 | 8403.048070 | 1758.225729 | 4650.421053 | 7403.684211 | 6209.087719 | 2244.596491 | 471.872281 | 2205.994736 | 1753.149123 | 2853.773158 | 3699.675439 |

| std | 173.503948 | 403.405858 | 81.319788 | 146.057225 | 60.288581 | 101.134432 | 237.407090 | 409.703802 | 152.041397 | 1243.157730 | 34.193845 | 256.656103 | 264.537545 | 239.741846 | 75.721260 | 16.497939 | 148.555222 | 89.980502 | 401.790333 | 129.866329 |

| min | 1729.000000 | 9750.000000 | 3300.000000 | 2575.000000 | 1482.000000 | 1548.000000 | 16.700001 | 4889.000000 | 2285.000000 | 81.739998 | 1684.302124 | 4193.000000 | 6738.000000 | 5764.000000 | 2081.000000 | 438.260010 | 1936.400024 | 1587.500000 | 28.070000 | 3451.500000 |

| 25% | 2157.000000 | 10244.000000 | 3426.000000 | 2671.000000 | 1586.000000 | 1712.000000 | 1691.500000 | 5162.000000 | 2424.000000 | 8200.000000 | 1732.252319 | 4404.000000 | 7220.000000 | 5986.000000 | 2210.000000 | 458.320007 | 2044.000000 | 1677.500000 | 2794.000000 | 3609.500000 |

| 50% | 2228.000000 | 10506.000000 | 3478.000000 | 2837.000000 | 1636.500000 | 1775.500000 | 1730.000000 | 5308.000000 | 2578.000000 | 8468.000000 | 1758.242188 | 4695.000000 | 7390.000000 | 6148.000000 | 2265.000000 | 469.200012 | 2225.000000 | 1761.000000 | 2872.000000 | 3690.500000 |

| 75% | 2267.000000 | 10800.000000 | 3528.500000 | 2919.000000 | 1678.500000 | 1837.500000 | 1796.500000 | 5710.000000 | 2661.000000 | 8944.000000 | 1783.400024 | 4841.000000 | 7632.000000 | 6428.000000 | 2299.000000 | 486.200012 | 2338.000000 | 1821.000000 | 2996.000000 | 3802.500000 |

| max | 2561.000000 | 11232.000000 | 3628.000000 | 3108.000000 | 1743.000000 | 1945.500000 | 1854.000000 | 6268.000000 | 2835.000000 | 9760.000000 | 1815.863037 | 5150.000000 | 7894.000000 | 6686.000000 | 2375.000000 | 505.239990 | 2440.000000 | 1920.000000 | 3148.000000 | 3943.000000 |

2. Prepare data by cleansing and feature engineering¶

Check null values. We will drop a row with null in this example for simplicity but please cosnider replacing the values if possible.

print(data.isna().sum()) # null row for each stock

ADM.L 0

AZN.L 0

BATS.L 1

BNZL.L 0

BRBY.L 0

CCH.L 0

CPG.L 1

DCC.L 1

EXPN.L 1

FLTR.L 0

GSK.L 0

IHG.L 1

LSEG.L 0

NXT.L 0

REL.L 0

SDR.L 0

SHEL.L 1

SSE.L 0

SVT.L 0

ULVR.L 0

dtype: int64

data_test.isna().sum() # check for test data

ADM.L 0

AZN.L 0

BATS.L 0

BNZL.L 0

BRBY.L 0

CCH.L 0

CPG.L 0

DCC.L 0

EXPN.L 0

FLTR.L 0

GSK.L 0

IHG.L 0

LSEG.L 0

NXT.L 0

REL.L 0

SDR.L 0

SHEL.L 0

SSE.L 0

SVT.L 0

ULVR.L 0

dtype: int64

data.dropna(inplace=True) # drop the rows

data.shape

(459, 20)

data_test.shape

(57, 20)

Feature Engineering¶

To make prediction, we use Prophet. See more at https://facebook.github.io/prophet/

We make time series prediction based on the historical data between July 2020 and April 2022. The period to predict is May 2022 till late July 2022, which is the same period of the data in test set.

The predicted values are transformed to be the average return rate for each stock. We can use it for one of the objectives to maximise the sum of return rates.

!pip install prophet

/bin/bash: /home/obm/Prog/miniconda3/envs/qml/lib/libtinfo.so.6: no version information available (required by /bin/bash)

Requirement already satisfied: prophet in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (1.1.1)

Requirement already satisfied: pandas>=1.0.4 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from prophet) (1.5.1)

Requirement already satisfied: python-dateutil>=2.8.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from prophet) (2.8.2)

Requirement already satisfied: cmdstanpy>=1.0.4 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from prophet) (1.0.8)

Requirement already satisfied: LunarCalendar>=0.0.9 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from prophet) (0.0.9)

Requirement already satisfied: wheel>=0.37.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from prophet) (0.37.1)

Requirement already satisfied: holidays>=0.14.2 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from prophet) (0.17.2)

Requirement already satisfied: tqdm>=4.36.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from prophet) (4.64.1)

Requirement already satisfied: numpy>=1.15.4 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from prophet) (1.23.4)

Requirement already satisfied: matplotlib>=2.0.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from prophet) (3.6.0)

Requirement already satisfied: setuptools-git>=1.2 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from prophet) (1.2)

Requirement already satisfied: setuptools>=42 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from prophet) (63.4.1)

Requirement already satisfied: convertdate>=2.1.2 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from prophet) (2.4.0)

Requirement already satisfied: pymeeus<=1,>=0.3.13 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from convertdate>=2.1.2->prophet) (0.5.12)

Requirement already satisfied: korean-lunar-calendar in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from holidays>=0.14.2->prophet) (0.3.1)

Requirement already satisfied: hijri-converter in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from holidays>=0.14.2->prophet) (2.2.4)

Requirement already satisfied: pytz in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from LunarCalendar>=0.0.9->prophet) (2022.7)

Requirement already satisfied: ephem>=3.7.5.3 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from LunarCalendar>=0.0.9->prophet) (4.1.4)

Requirement already satisfied: pillow>=6.2.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from matplotlib>=2.0.0->prophet) (9.2.0)

Requirement already satisfied: kiwisolver>=1.0.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from matplotlib>=2.0.0->prophet) (1.4.4)

Requirement already satisfied: pyparsing>=2.2.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from matplotlib>=2.0.0->prophet) (3.0.9)

Requirement already satisfied: packaging>=20.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from matplotlib>=2.0.0->prophet) (21.3)

Requirement already satisfied: fonttools>=4.22.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from matplotlib>=2.0.0->prophet) (4.37.4)

Requirement already satisfied: cycler>=0.10 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from matplotlib>=2.0.0->prophet) (0.11.0)

Requirement already satisfied: contourpy>=1.0.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from matplotlib>=2.0.0->prophet) (1.0.5)

Requirement already satisfied: six>=1.5 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from python-dateutil>=2.8.0->prophet) (1.16.0)

[notice] A new release of pip available: 22.3 -> 22.3.1

[notice] To update, run: pip install --upgrade pip

from prophet import Prophet

ERROR:prophet.plot:Importing plotly failed. Interactive plots will not work.

pred_return_rate = []

pred_return_rate_mean = []

i = 0 # current index of stock

N = 20 # number of candidate stocks

periods = data_test.shape[0] # number of days to forecast, same as data_test length

for i in range(N): # for each stock

model = Prophet()

data['ds'] = data.index # index values (dates) as ds

data['y'] = data.iloc[:,i] # stock close price as y

stock_data = data[['ds','y']] # training data

model.fit(stock_data)

future = model.make_future_dataframe(periods=periods) # predict

forecast = model.predict(future)['yhat'] # predicted values stored in yhat column

return_rate = np.zeros(len(forecast)) # return rate to be stored in numpy array

for j in range(len(forecast)-1):

return_rate[j+1] = (forecast[j+1] - forecast[j])/forecast[j] # calculate the return rate per day

pred_return_rate.append(return_rate)

pred_return_rate_mean.append(np.mean(return_rate)) # predicted mean return rate for the stock

data.drop(columns=['ds','y'], inplace=True)

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/skex3r5n.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/8eglu_aj.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=23638', 'data', 'file=/tmp/tmpe07d9yq5/skex3r5n.json', 'init=/tmp/tmpe07d9yq5/8eglu_aj.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modelg0zqix38/prophet_model-20221222121631.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:31 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:31 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/052ut3s8.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/swzcijw4.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=17686', 'data', 'file=/tmp/tmpe07d9yq5/052ut3s8.json', 'init=/tmp/tmpe07d9yq5/swzcijw4.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modely5g46xyq/prophet_model-20221222121632.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:32 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:32 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/es1uny16.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/63bplu6q.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=91517', 'data', 'file=/tmp/tmpe07d9yq5/es1uny16.json', 'init=/tmp/tmpe07d9yq5/63bplu6q.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modelwnhpvk3_/prophet_model-20221222121632.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:32 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:32 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/cylm8696.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/kk03bnzs.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=81409', 'data', 'file=/tmp/tmpe07d9yq5/cylm8696.json', 'init=/tmp/tmpe07d9yq5/kk03bnzs.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modelexnjnl_m/prophet_model-20221222121632.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:32 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:32 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/vd8s_xnk.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/n8j7f_dd.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=10998', 'data', 'file=/tmp/tmpe07d9yq5/vd8s_xnk.json', 'init=/tmp/tmpe07d9yq5/n8j7f_dd.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modeld0xvxd8y/prophet_model-20221222121633.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:33 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:33 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/ry7mprqi.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/ybvjqwrf.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=61378', 'data', 'file=/tmp/tmpe07d9yq5/ry7mprqi.json', 'init=/tmp/tmpe07d9yq5/ybvjqwrf.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modelrg_q5vmx/prophet_model-20221222121633.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:33 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:33 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/ig23xk22.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/qdw_gm1u.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=88980', 'data', 'file=/tmp/tmpe07d9yq5/ig23xk22.json', 'init=/tmp/tmpe07d9yq5/qdw_gm1u.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modelnvhx7wuy/prophet_model-20221222121633.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:33 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:33 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/ekpsf0b4.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/ksxnhchk.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=60911', 'data', 'file=/tmp/tmpe07d9yq5/ekpsf0b4.json', 'init=/tmp/tmpe07d9yq5/ksxnhchk.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modely39vk739/prophet_model-20221222121634.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:34 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:34 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/0qmul04z.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/sdeq5y5b.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=55767', 'data', 'file=/tmp/tmpe07d9yq5/0qmul04z.json', 'init=/tmp/tmpe07d9yq5/sdeq5y5b.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modeldixoqs6p/prophet_model-20221222121634.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:34 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:34 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/bzppo40u.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/nii8lkpy.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=55520', 'data', 'file=/tmp/tmpe07d9yq5/bzppo40u.json', 'init=/tmp/tmpe07d9yq5/nii8lkpy.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modelu5mxui7g/prophet_model-20221222121634.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:34 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:35 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/ol16hhgg.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/pb5krrj0.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=79316', 'data', 'file=/tmp/tmpe07d9yq5/ol16hhgg.json', 'init=/tmp/tmpe07d9yq5/pb5krrj0.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modelahv6j1e7/prophet_model-20221222121635.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:35 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:35 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/y16zipx0.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/f9n1f9ih.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=6867', 'data', 'file=/tmp/tmpe07d9yq5/y16zipx0.json', 'init=/tmp/tmpe07d9yq5/f9n1f9ih.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modela9i6besj/prophet_model-20221222121635.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:35 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:35 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/6fk9spa1.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/17u09qm5.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=53221', 'data', 'file=/tmp/tmpe07d9yq5/6fk9spa1.json', 'init=/tmp/tmpe07d9yq5/17u09qm5.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_model4kbc_lsk/prophet_model-20221222121636.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:36 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:36 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/60_ptvjz.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/rno5elri.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=34168', 'data', 'file=/tmp/tmpe07d9yq5/60_ptvjz.json', 'init=/tmp/tmpe07d9yq5/rno5elri.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modelf5gv4e98/prophet_model-20221222121636.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:36 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:36 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/qpnqpham.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/ghjrsror.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=45374', 'data', 'file=/tmp/tmpe07d9yq5/qpnqpham.json', 'init=/tmp/tmpe07d9yq5/ghjrsror.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modelktys17lh/prophet_model-20221222121636.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:36 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:36 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/brmnv4l1.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/68kjgs0t.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=51331', 'data', 'file=/tmp/tmpe07d9yq5/brmnv4l1.json', 'init=/tmp/tmpe07d9yq5/68kjgs0t.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modelss6xg87a/prophet_model-20221222121637.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:37 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:37 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/xpzy2i_b.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/bo_t_qas.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=39935', 'data', 'file=/tmp/tmpe07d9yq5/xpzy2i_b.json', 'init=/tmp/tmpe07d9yq5/bo_t_qas.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modelfn0km4gm/prophet_model-20221222121637.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:37 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:37 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/smatzxr6.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/lklye49q.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=63219', 'data', 'file=/tmp/tmpe07d9yq5/smatzxr6.json', 'init=/tmp/tmpe07d9yq5/lklye49q.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_model3vq_aokf/prophet_model-20221222121637.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:37 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:37 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/7ah9njlh.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/6zojv1br.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=2477', 'data', 'file=/tmp/tmpe07d9yq5/7ah9njlh.json', 'init=/tmp/tmpe07d9yq5/6zojv1br.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modelvwnz2hcl/prophet_model-20221222121638.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:38 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:38 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

INFO:prophet:Disabling yearly seasonality. Run prophet with yearly_seasonality=True to override this.

INFO:prophet:Disabling daily seasonality. Run prophet with daily_seasonality=True to override this.

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/to_oa922.json

DEBUG:cmdstanpy:input tempfile: /tmp/tmpe07d9yq5/2hnnidxp.json

DEBUG:cmdstanpy:idx 0

DEBUG:cmdstanpy:running CmdStan, num_threads: None

DEBUG:cmdstanpy:CmdStan args: ['/home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/prophet/stan_model/prophet_model.bin', 'random', 'seed=42296', 'data', 'file=/tmp/tmpe07d9yq5/to_oa922.json', 'init=/tmp/tmpe07d9yq5/2hnnidxp.json', 'output', 'file=/tmp/tmpe07d9yq5/prophet_modele4gx5s0x/prophet_model-20221222121638.csv', 'method=optimize', 'algorithm=lbfgs', 'iter=10000']

12:16:38 - cmdstanpy - INFO - Chain [1] start processing

INFO:cmdstanpy:Chain [1] start processing

12:16:38 - cmdstanpy - INFO - Chain [1] done processing

INFO:cmdstanpy:Chain [1] done processing

print(pred_return_rate_mean)

[-3.295120211693522e-05, 0.0004212352164733634, 0.0006443323333763341, 0.0006180876152479546, 0.0005054489754747284, -0.0011332381597290778, 0.0009594389542370872, -0.0004696525374264205, -0.0002568726047600979, -0.0010414517228963223, 0.00016392271944240828, 0.0006151834219843348, -9.028002715718702e-05, -6.64373367560175e-05, 0.0005966905208675229, -0.00019014641894963337, 0.0011606326569417041, 0.0005490521838582731, 0.0004985535894805963, -0.0005879920495425485]

print(np.mean(pred_return_rate_mean))

0.00014317780640250334

We also calculate actual return rates from the historical stock price data. We will use the results for the calculation of covariance that will be used for the second objective function to reduce the risk by diversify the portfolio items to avoid losing it altogether.

actual_return_rate = []

actual_return_rate_mean = []

N = 20 # number of candidate stocks

for i in range(N): # for each stock

stock_data = data.iloc[:,i]

return_rate = np.zeros(len(stock_data)) # return rate to be stored in numpy array

for j in range(len(stock_data)-1):

return_rate[j+1] = (stock_data[j+1] - stock_data[j])/stock_data[j] # calculate the return rate per day

actual_return_rate.append(return_rate)

actual_return_rate_mean.append(np.mean(return_rate)) # predicted mean return rate for the stock

actual_return_rate_mean_mean = np.mean(actual_return_rate_mean)

actual_return_rate_mean_mean

0.00039797518633514584

Finally, we calculate the actual return rates on the test set for the final evaluation.

actual_return_rate_test = []

actual_return_rate_mean_test = []

N = 20 # number of candidate stocks

for i in range(N): # for each stock

stock_data = data_test.iloc[:,i]

return_rate = np.zeros(len(stock_data)) # return rate to be stored in numpy array

for j in range(len(stock_data)-1):

return_rate[j+1] = (stock_data[j+1] - stock_data[j])/stock_data[j] # calculate the return rate per day

actual_return_rate_test.append(return_rate)

actual_return_rate_mean_test.append(np.mean(return_rate)) # predicted mean return rate for the stock

actual_return_rate_mean_mean_test = np.mean(actual_return_rate_mean_test)

actual_return_rate_mean_mean_test

0.26481830738480705

#3. Formulate the cost functions and constraints to obtain a QUBO matrix

Constraint Terms¶

In our portfolio optimisation example, let’s assume 1 constraint: the number of stock to be included in the portfolio.

In this example, we will use PyQubo, a python library that that can conver the cost function to a quadratic unconstraintbinary optimisation matrix that can be sent to D-wave qunatum annealer and JIJ simulated quantum annealer.

!pip install pyqubo # https://pyqubo.readthedocs.io/en/latest/index.html

/bin/bash: /home/obm/Prog/miniconda3/envs/qml/lib/libtinfo.so.6: no version information available (required by /bin/bash)

Requirement already satisfied: pyqubo in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (1.3.1)

Requirement already satisfied: dimod<0.13,>=0.9.14 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from pyqubo) (0.12.3)

Requirement already satisfied: Deprecated>=1.2.12 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from pyqubo) (1.2.13)

Requirement already satisfied: six>=1.15.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from pyqubo) (1.16.0)

Requirement already satisfied: dwave-neal>=0.5.7 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from pyqubo) (0.6.0)

Requirement already satisfied: numpy>=1.17.3 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from pyqubo) (1.23.4)

Requirement already satisfied: wrapt<2,>=1.10 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from Deprecated>=1.2.12->pyqubo) (1.14.1)

Requirement already satisfied: dwave-samplers<2.0.0,>=1.0.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-neal>=0.5.7->pyqubo) (1.0.0)

Requirement already satisfied: networkx>=2.4.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-samplers<2.0.0,>=1.0.0->dwave-neal>=0.5.7->pyqubo) (2.8.7)

[notice] A new release of pip available: 22.3 -> 22.3.1

[notice] To update, run: pip install --upgrade pip

from pyqubo import Array, Constraint, Placeholder

x = Array.create('x',shape=N, vartype='BINARY') # array takes binary 0 or 1 indicate to exclude or include a stock in the portfolio, which we need to optimise

# number of stocks constraint

num_stocks = 10 # specify the desired number of stocks

h_const1 = (num_stocks - np.dot(x,x))**2 # MSE from the budget. This lead to x values that makes the portfolio as close as the budget

Cost Functions¶

We have set two cost functions to optimise our portfolio. One is to maximise the sum of predicted growth rates that we predicted in the feature engineering section. Another is to minimise the covariance between each of the stock items to be selected in the portfolio. We then add up two cost functions for QUBO.

# cost function 1 to aim the highest return

h_cost1 = 0

h_cost1 -= np.dot(x,pred_return_rate_mean) # maximisation problem. negative to make it minimisation problem

# cost function 2 to balance the portfolio not to put all eggs in one basket

# minimising the sum of covariance leads to the safer choice

h_cost2 = 0

for i in range(N):

for j in range(N):

h_cost2 += x[i]*x[j]*np.sum((actual_return_rate[i]-actual_return_rate_mean[i])*(actual_return_rate[j]-actual_return_rate_mean[j]))/len(actual_return_rate[i])

h_cost = h_cost1 + h_cost2

Prepare QUBO¶

The problme formulation and representation in QUBO format are habled by PyQubo applications. In the lines below, we compile the model using the objective function that needs to be minimised, then define the constraint coefficient. to_qubo function generates a QUBO matrix in the dictionary type and an offset value which is an costanct value not required for the search for the minimum.

h = h_cost + Placeholder('l1')*Constraint(h_const1,label='num_stocks')

model = h.compile()

feed_dict = {'l1': 2}

qubo, offset = model.to_qubo(feed_dict=feed_dict)

offset

200.0

4. Sample optimisation results from a D-Wave solver¶

Install D-Wave’s Ocean SDK to request the computation to the quantum annealer. EmbeddingComposite is used to embed the QUBO to the physical quantum anneler in D-Wave.

!pip install dwave-ocean-sdk # https://docs.ocean.dwavesys.com/en/stable/

/bin/bash: /home/obm/Prog/miniconda3/envs/qml/lib/libtinfo.so.6: no version information available (required by /bin/bash)

Requirement already satisfied: dwave-ocean-sdk in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (6.1.1)

Requirement already satisfied: minorminer==0.2.9 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (0.2.9)

Requirement already satisfied: dwave-tabu==0.5.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (0.5.0)

Requirement already satisfied: dwave-samplers==1.0.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (1.0.0)

Requirement already satisfied: dwave-preprocessing==0.5.3 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (0.5.3)

Requirement already satisfied: dimod==0.12.3 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (0.12.3)

Requirement already satisfied: dwavebinarycsp==0.2.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (0.2.0)

Requirement already satisfied: dwave-inspector==0.3.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (0.3.0)

Requirement already satisfied: penaltymodel==1.0.2 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (1.0.2)

Requirement already satisfied: dwave-system==1.18.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (1.18.0)

Requirement already satisfied: pyqubo==1.3.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (1.3.1)

Requirement already satisfied: dwave-greedy==0.3.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (0.3.0)

Requirement already satisfied: dwave-hybrid==0.6.9 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (0.6.9)

Requirement already satisfied: dwave-neal==0.6.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (0.6.0)

Requirement already satisfied: dwave-cloud-client==0.10.3 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (0.10.3)

Requirement already satisfied: dwave-networkx==0.8.12 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-ocean-sdk) (0.8.12)

Requirement already satisfied: numpy<2.0.0,>=1.17.3 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dimod==0.12.3->dwave-ocean-sdk) (1.23.4)

Requirement already satisfied: homebase>=1.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-cloud-client==0.10.3->dwave-ocean-sdk) (1.0.1)

Requirement already satisfied: pydantic>=1.7.3 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-cloud-client==0.10.3->dwave-ocean-sdk) (1.10.2)

Requirement already satisfied: diskcache>=5.2.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-cloud-client==0.10.3->dwave-ocean-sdk) (5.4.0)

Requirement already satisfied: requests[socks]>=2.18 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-cloud-client==0.10.3->dwave-ocean-sdk) (2.28.1)

Requirement already satisfied: python-dateutil>=2.7 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-cloud-client==0.10.3->dwave-ocean-sdk) (2.8.2)

Requirement already satisfied: plucky>=0.4.3 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-cloud-client==0.10.3->dwave-ocean-sdk) (0.4.3)

Requirement already satisfied: click>=7.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-cloud-client==0.10.3->dwave-ocean-sdk) (8.1.3)

Requirement already satisfied: networkx in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-hybrid==0.6.9->dwave-ocean-sdk) (2.8.7)

Requirement already satisfied: importlib-resources>=3.2.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-inspector==0.3.0->dwave-ocean-sdk) (5.2.0)

Requirement already satisfied: Flask>=1.1.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-inspector==0.3.0->dwave-ocean-sdk) (2.2.2)

Requirement already satisfied: scipy>=1.7.3 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from dwave-system==1.18.0->dwave-ocean-sdk) (1.9.3)

Requirement already satisfied: fasteners in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from minorminer==0.2.9->dwave-ocean-sdk) (0.18)

Requirement already satisfied: rectangle-packer>=2.0.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from minorminer==0.2.9->dwave-ocean-sdk) (2.0.1)

Requirement already satisfied: Deprecated>=1.2.12 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from pyqubo==1.3.1->dwave-ocean-sdk) (1.2.13)

Requirement already satisfied: six>=1.15.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from pyqubo==1.3.1->dwave-ocean-sdk) (1.16.0)

Requirement already satisfied: wrapt<2,>=1.10 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from Deprecated>=1.2.12->pyqubo==1.3.1->dwave-ocean-sdk) (1.14.1)

Requirement already satisfied: importlib-metadata>=3.6.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from Flask>=1.1.1->dwave-inspector==0.3.0->dwave-ocean-sdk) (5.0.0)

Requirement already satisfied: Werkzeug>=2.2.2 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from Flask>=1.1.1->dwave-inspector==0.3.0->dwave-ocean-sdk) (2.2.2)

Requirement already satisfied: itsdangerous>=2.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from Flask>=1.1.1->dwave-inspector==0.3.0->dwave-ocean-sdk) (2.1.2)

Requirement already satisfied: Jinja2>=3.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from Flask>=1.1.1->dwave-inspector==0.3.0->dwave-ocean-sdk) (3.0.3)

Requirement already satisfied: zipp>=3.1.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from importlib-resources>=3.2.0->dwave-inspector==0.3.0->dwave-ocean-sdk) (3.9.0)

Requirement already satisfied: typing-extensions>=4.1.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from pydantic>=1.7.3->dwave-cloud-client==0.10.3->dwave-ocean-sdk) (4.4.0)

Requirement already satisfied: urllib3<1.27,>=1.21.1 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from requests[socks]>=2.18->dwave-cloud-client==0.10.3->dwave-ocean-sdk) (1.26.12)

Requirement already satisfied: charset-normalizer<3,>=2 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from requests[socks]>=2.18->dwave-cloud-client==0.10.3->dwave-ocean-sdk) (2.1.1)

Requirement already satisfied: certifi>=2017.4.17 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from requests[socks]>=2.18->dwave-cloud-client==0.10.3->dwave-ocean-sdk) (2022.9.24)

Requirement already satisfied: idna<4,>=2.5 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from requests[socks]>=2.18->dwave-cloud-client==0.10.3->dwave-ocean-sdk) (3.4)

Requirement already satisfied: PySocks!=1.5.7,>=1.5.6 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from requests[socks]>=2.18->dwave-cloud-client==0.10.3->dwave-ocean-sdk) (1.7.1)

Requirement already satisfied: MarkupSafe>=2.0 in /home/obm/Prog/miniconda3/envs/qml/lib/python3.8/site-packages (from Jinja2>=3.0->Flask>=1.1.1->dwave-inspector==0.3.0->dwave-ocean-sdk) (2.1.1)

[notice] A new release of pip available: 22.3 -> 22.3.1

[notice] To update, run: pip install --upgrade pip

from dwave.system import DWaveSampler, EmbeddingComposite

endpoint = 'https://cloud.dwavesys.com/sapi'

token = '***' # Please relace with your own token

Available annelers depend on the geographic location and machine’s online status. The list of solvers can be found on the D-Wave Leap dashboard.

sampler_dw = DWaveSampler(solver='Advantage_system4.1',token=token)

sampler_qa = EmbeddingComposite(sampler_dw)

---------------------------------------------------------------------------

SolverAuthenticationError Traceback (most recent call last)

Input In [43], in <cell line: 1>()

----> 1 sampler_dw = DWaveSampler(solver='Advantage_system4.1',token=token)

2 sampler_qa = EmbeddingComposite(sampler_dw)

File ~/Prog/miniconda3/envs/qml/lib/python3.8/site-packages/dwave/system/samplers/dwave_sampler.py:185, in DWaveSampler.__init__(self, failover, retry_interval, **config)

182 self._solver_penalty = defaultdict(int)

184 self.client = Client.from_config(**config)